What Investors and Homebuyers Need to Know

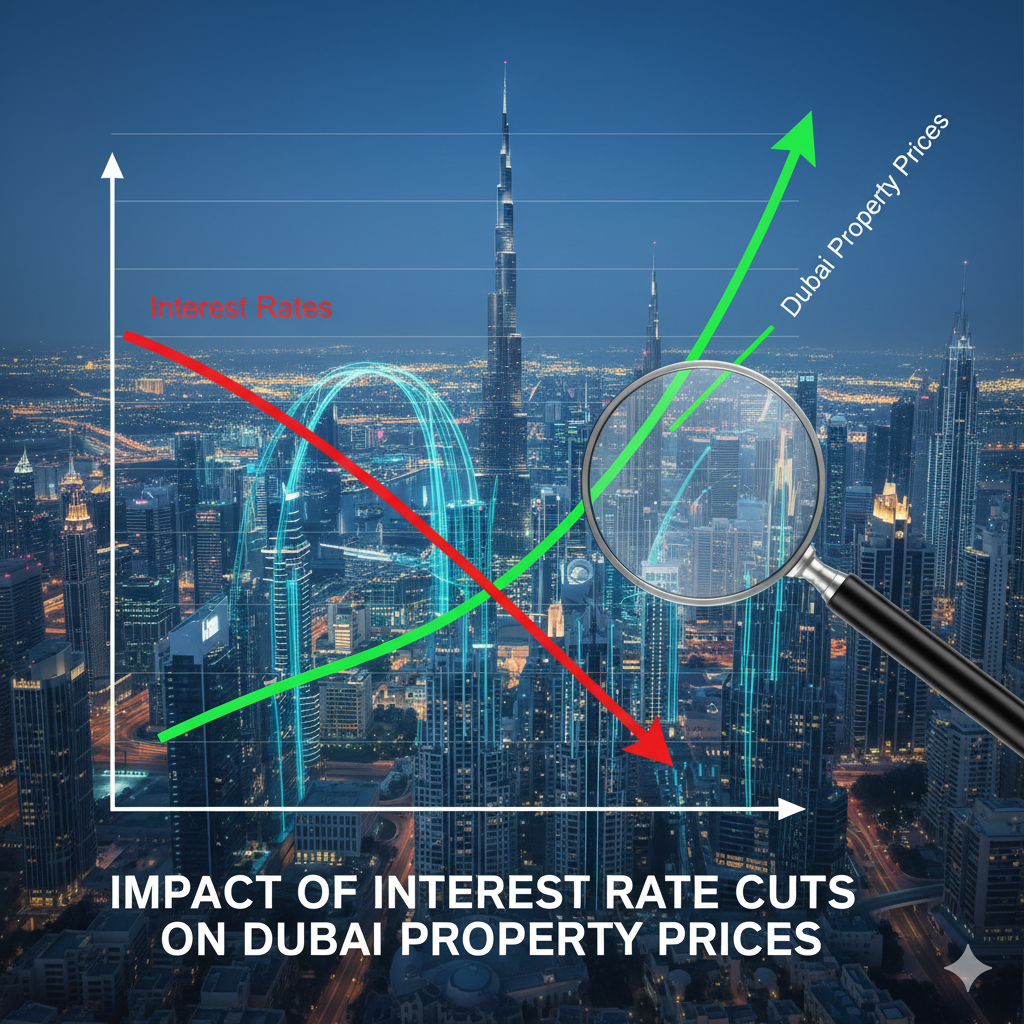

Interest rate cuts are among the most powerful economic tools influencing global real estate markets—and Dubai’s property market is no exception. As borrowing becomes cheaper, buyer sentiment improves, demand increases, and property prices often respond positively.

This blog explores the impact of interest rate cuts on Dubai property prices, helping investors and homebuyers understand opportunities, risks, and timing strategies.

Understanding Interest Rate Cuts and Real Estate

Interest rates directly affect mortgage affordability. When central banks reduce rates, banks lower home loan interest rates, making property purchases more accessible.

High-intent search terms:

- Interest rate cuts’ impact on property prices

- Dubai mortgage interest rates

- Buy property in Dubai 2026

- Dubai real estate investment opportunities

Why Dubai’s Property Market Is Highly Sensitive to Rate Cuts

Dubai’s real estate sector is particularly responsive due to:

- A large percentage of mortgage-based buyers

- Strong inflow of international investors

- A dynamic off-plan and luxury property market

- Pegging of the AED to the USD, aligning rates with global trends

Short-Term Impact on Dubai Property Prices

1. Increased Buyer Demand

Lower interest rates encourage:

- First-time buyers to enter the market

- End-users to upgrade homes

- Investors to leverage financing

This immediate surge in demand often leads to price stabilization or short-term appreciation, especially in high-demand communities.

2. Boost in Off-Plan Property Sales

Developers benefit significantly from rate cuts as buyers find it easier to commit to off-plan properties with flexible payment plans.

Popular transactional keywords:

- Off-plan properties in Dubai

- New projects with post-handover payment plans

- Buy off-plan apartments in Dubai

Long-Term Impact on Dubai Property Prices

1. Sustained Price Growth

Prolonged low interest rates can support steady price appreciation, particularly in:

- Prime waterfront locations

- Luxury villas and branded residences

- Transit-oriented developments

2. Higher Rental Demand and Yields

As property prices rise gradually, rental demand also increases due to population growth, tourism, and business expansion—supporting strong rental yields.

Which Dubai Property Segments Benefit the Most?

✔ Affordable & Mid-Income Apartments

Lower EMIs make apartments more accessible to salaried residents.

✔ Luxury & Ultra-Luxury Properties

High-net-worth investors leverage cheaper financing to acquire premium assets.

✔ Off-Plan Developments

Interest rate cuts paired with developer incentives create ideal buying conditions.

Areas Likely to See the Biggest Price Impact

- Dubai Marina

- Downtown Dubai

- Business Bay

- Dubai Creek Harbour

- Palm Jumeirah

- Jumeirah Village Circle (JVC)

These locations already show strong transaction volumes and are the first to react to rate changes.

Risks to Watch Despite Interest Rate Cuts

- Over-leveraging by investors

- Speculative buying leading to short-term price spikes

- Global economic volatility is affecting foreign investment

Smart buyers focus on long-term fundamentals, not just cheap borrowing.

Strategic Tips for Buyers and Investors

- Lock in fixed-rate mortgages during low-rate cycles

- Focus on high-demand, well-connected communities

- Prioritize reputable developers

- Plan clear exit or rental strategies

Final Thoughts: Is Now a Good Time to Buy in Dubai?

Interest rate cuts typically create a favorable window for property buyers in Dubai. Lower borrowing costs, rising demand, and strong market fundamentals combine to support price growth and attractive returns.

For investors and end-users alike, understanding the timing and choosing the right asset can make all the difference.