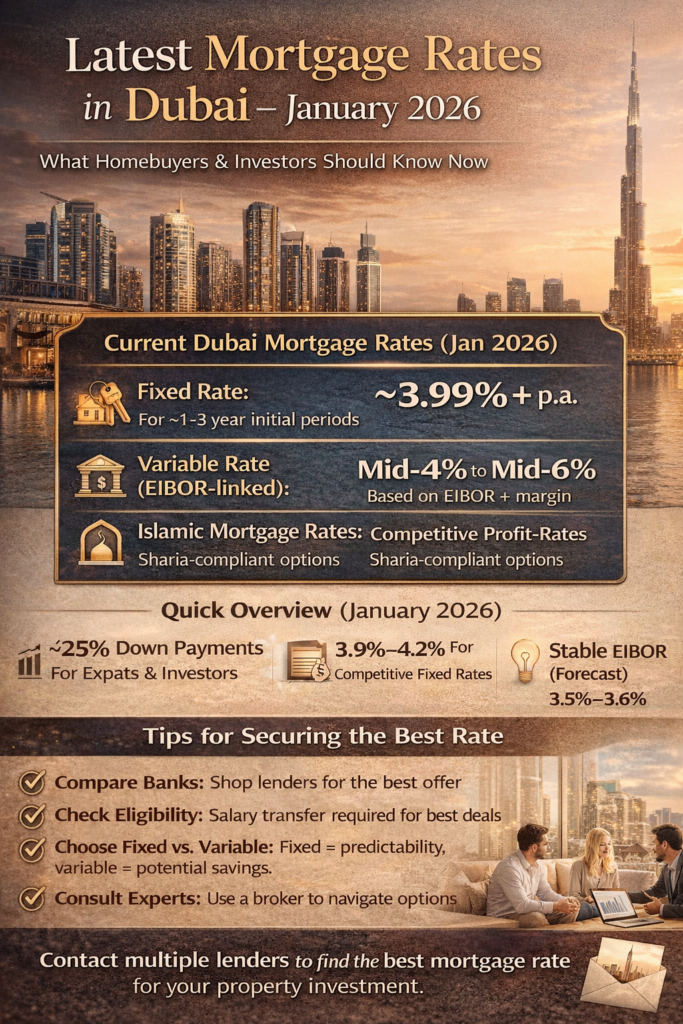

What Homebuyers & Investors Should Know Now

As we kick off 2026, mortgage rates in Dubai and across the UAE remain a key factor shaping real estate buying decisions. With global economics evolving, local monetary policy adjusting, and competitive bank offerings hitting the market, understanding current mortgage pricing is essential for anyone planning to buy, refinance, or invest in Dubai property.

📊 Current Mortgage Rate Landscape (January 2026)

In Dubai’s mortgage market today, interest rates vary by bank, loan structure, borrower profile, and whether the product is fixed or variable. Here’s a snapshot of prevailing rates:

🔹 Fixed Mortgage Rates

- Many leading lenders are offering fixed home loan rates starting around ~3.99% per annum for initial periods (e.g., 1–3 years), especially with salary transfer or bundled banking products.

- Some promotional offerings can be marginally lower depending on eligibility.

🔹 Variable / EIBOR-Linked Rates

- Variable mortgage pricing in the UAE is typically set as EIBOR (Emirates Interbank Offered Rate) + a bank margin.

- As of mid-January 2026, 3-month and 6-month EIBOR levels are near ~3.5%–3.6%, meaning total variable costs can range higher depending on lender mark-ups.

- Brokers and buyers report typical variable effective rates often landing in the mid-4% to mid-6% area, depending on loan-to-value (LTV), repayment terms, and bank strategy.

🕌 Islamic Mortgage (Home Finance)

Sharia-compliant products from Islamic banks in Dubai, such as Emirates Islamic or Dubai Islamic Bank, follow profit-rate pricing structures. These often appear competitive with conventional fixed-rate offerings for certain customers.

📉 Why Rates Are Where They Are

🔸 Central Bank Policy

The Central Bank of the UAE has cut its base rate in response to global monetary trends, especially shifts from the U.S. Federal Reserve, bringing down the borrowing cost backdrop that banks use to price lending.

🔸 Benchmarks & Forecasts

Mortgage specialists forecast the EIBOR benchmark to remain relatively stable in early 2026 — with modest declines rather than sharp cuts — reflecting a cautious global rate outlook.

💡 What This Means for Buyers

🔹 First-Time Buyers & Expats

- Competitive fixed rates close to 3.9%–4.2% can make monthly payments more predictable.

- LTV limits for expats typically involve down payments of ~25% or more depending on property value and residency status.

🔹 Investors & Refinancers

- Existing borrowers with variable or floating rates could consider refinancing if new fixed deals are more appealing.

- Lower Base Rates may improve affordability, though pricing is highly individual. Experts suggest reviewing offers across banks before committing.

📘 Tips for Securing the Right Rate

✔ Compare banks: Different lenders price their products uniquely, so shop around.

✔ Know your profile: Salary transfer, resident status, credit history, and LTV affect pricing.

✔ Consider loan type: Fixed for stability vs. variable for potential future rate drops.

✔ Use a mortgage calculator: Estimate payments before you negotiate.

📌 Quick Summary

| Mortgage Component | Typical Range (Jan 2026) |

|---|---|

| Fixed Rate (initial) | ~3.99%+ p.a. (with conditions) |

| Variable Rate (EIBOR + margin) | Mid-4% to mid-6% (depending on bank) |

| Islamic Mortgage Pricing | Competitive with conventional |

Note: Individual offers can vary widely — always confirm directly with the lender before applying.

📍 Bottom Line

Dubai’s mortgage rates in January 2026 remain relatively favorable compared to historical peaks, with fixed options around high-3% to low-4% and variable structures tied to a stable EIBOR benchmark. While the global rate environment suggests stability over drastic cuts in early 2026, buyers with strong profiles may find competitive home loan deals.

Ready to buy? Use this data as a starting point for comparison — and talk to multiple lenders to secure the best rate and terms for your property goals.